- No maintenance or service fees

- No minimum deposit requirement

- Complimentary ATM card

- Digital tools for seamless remote banking

- Free transfers between direct deposit accounts

| Institution | APY* | Min Deposit for APY | |

|---|---|---|---|

|

Advertiser comments

|

5.15% APY As of: 7/27/2024 | $0.00 |

Sponsored

Learn more

|

|

Advertiser comments

|

4.25% APY As of: 7/27/2024 | $0.00 |

Sponsored

Learn more

|

|

Advertiser comments

|

4.75% APY As of: 7/27/2024 | $0.00 |

Sponsored

Learn more

|

|

Advertiser comments

|

4.60% APY As of: 7/27/2024 | $0.00 |

Sponsored

Learn more

|

|

|

0.1% APY | $1 | |

|

|

0.1% APY | $1 | |

|

|

0.1% APY | $0 |

* Rates / Annual Percentage Yield terms above are current as of the date indicated. These quotes are from banks, credit unions and thrifts, some of which have paid for a link to their website. Bank, thrift and credit unions are member FDIC or NCUA. Contact the bank for the terms and conditions that may apply to you. Rates are subject to change without notice and may not be the same at all branches.

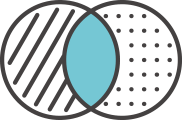

What’s the Difference?

Did you know there are two types of bank accounts that can earn you interest? Both traditional savings accounts and money market accounts (MMAs) pay interest, and your funds are insured by the FDIC up to the maximum amount allowed by law. Additionally, both allow you to make as many deposits as you want. However, for both accounts there is a limit of six withdrawals or transfers per statement cycle — a limit set by federal law.

- Withdrawals can typically be made with checks or debit cards.

- Interest rates are sometimes lower with more convenient ways to access funds and make payments through the account.

- Might be best to use for saving and making related payments like saving for a house, paying for inspections and contracting repairs.

- Withdrawals must be made via electronic transfer or in person at the bank.

- Interest rates are sometimes higher with more restrictions on how you access the funds in the account.

- Might be best to use for emergency funds and saving for future large purchases.